Rishi Sunak has announced a range of measures in his summer statement, from a bonus scheme for employers who retain furloughed workers to a cut in VAT for the hospitality and leisure sectors and a stamp duty holiday. Here is the reaction from people who have been affected by the changes.

Furlough bonus scheme: the employee

“Anxiety and worry is in the back of your mind and with each passing week I’m feeling it growing,” said Nitin Chavda, 56, who worked as an events manager in London until his company halted operations in March owing to coronavirus.

“They gave us our last salary, and within a week or so the furlough scheme was announced and we were able to get in on that.”

Chavda does not expect to return to his current job because the events industry is unlikely to recover until a vaccine is available. His company provides the physical spaces that host events, so it is unable to shift online.

“One of our spaces holds 150 people, if we reduce it down to 80 will that be a viable venture for us, will we run it at a loss? There are too many uncertainties to know. For industries like ours, the hardest hit, furlough should definitely go on longer.”

Chavda has been looking for jobs, but has found no one in the events industry is hiring, while his skills from a former tech job are now out of date. He also tried applying for supermarket work, but was unsuccessful.

As lockdown eases, he hopes there will be more job opportunities available. “It looks bleak but I can’t think of anything else other than to find other employment,” he said. “I’m very worried. I just moved at the beginning of the year and my savings are very little. I really can’t survive much longer.”

On the chancellor’s announcement, even though he doesn’t expect to benefit from the retention bonus, he welcomed it. “The job retention bonus for those on the furlough scheme is a great incentive – totally unexpected,” he said. “I’m sure there are some companies who have been wondering whether they will be able to continue or not and this is a nice little bonus for them.

“Sadly it doesn’t affect me due to the nature of the events industry and us relying on people gathering together. I didn’t think an extension to the furlough scheme would be realistic but I’m glad at least that he hasn’t shortened it.”

Furlough bonus scheme: the employer

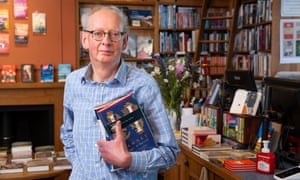

Every employee at Topping & Company Booksellers, apart from the founder, Robert Topping, and his son Hugh, has been paid directly by the government since March on the furlough scheme.

Now the family-run book chain stands to receive up to £50,000 should all 50 employees be brought back and stay with the firm until the end of January.

But despite suffering a sharp drop in sales after closing its shops in Ely, Bath, St Andrews and Edinburgh during lockdown, 63 year-old Robert Topping had plans well before the chancellor’s speech to bring back all his staff next month.

“We intended to do it anyway, but it’s a little bit of a help. It’s only a fraction of what it will cost to bring everyone back from furlough – but it is a little extra,” he said.

“Five months’ salary is going to be considerably more than £1,000 but it’s going to be something.”

Having previously hosted famous authors including Sebastian Faulks and Alan Bennett at live events and readings, as much as 95% of sales were face to face before coronavirus struck, meaning it was left with virtually no income. As well as furlough support, the company was also helped by a £250,000 coronavirus business interruption loan from Lloyds Bank to stay afloat.

Since reopening as lockdown is relaxed, sales have bounced back but remain below usual. Topping said he hoped the chancellor’s speech would encourage customers to return. “It is a difficult time in the whole country but we have to hope for the best and pull through. Chain stores will have a much more difficult time, but bookshops are places with personality and character. Touching wood – and there’s lots of it in a bookshop to touch – I hope we’ll be OK.”

Stamp duty holiday: the house buyer

Gemma Nesbit and her partner will save almost £9,000 as a result of the stamp duty holiday for England and Northern Ireland, freeing up much-needed funds for them to spend elsewhere. The couple are in the process of buying a family home – a new-build four-bedroom semi-detached house – in Eastbourne, East Sussex.

Nesbit, 34, said: “We’re really pleased. This makes a huge difference for us, and takes the financial pressure off us.”

The stamp duty that they would ordinarily have had to pay was “money we didn’t really have and that we were scraping together”, she added.

The couple are expecting to exchange in a few weeks’ time and complete in the middle of August. The property they are buying is priced at about £370,000, so the announcement means they escape having to pay any stamp duty.

Nesbit, a mother-of-two who works as a finance manager, said they would be able to channel the money saved towards meeting some of the costs associated with their new home, such as putting down flooring and carpets.

She and her partner, Ryan Maslin, previously owned a property which they sold at the start of this year, just before the lockdown, and are currently renting in Eastbourne. They reserved their new property just as the restrictions on viewing homes were being lifted.

Before the announcement there had been speculation that any stamp duty holiday might be delayed until the autumn. Nesbit said that if that was what ended up happening, she and her partner would have considered seeing whether they could push their completion date through to the autumn.

VAT cut for hospitality and tourism: the pub landlord

While alcohol has been excluded from the six-month cut in VAT for hospitality and tourism, pubs that make most of their money from selling food welcomed the move.

Stosie Madi, who runs the Parker’s Arms in rural Lancashire near Clitheroe, said she wasn’t expecting the rate to fall from 20% to as low as 5%.

“We thought it might be 12% to 15%. The new rate is great, it’s very hopeful for businesses like us that have a chance of surviving and seeing the winter through.”

Madi predicted that pubs and restaurants who were still reeling from the loss of business during the lockdown were unlikely to use the reduced tax burden to cut prices.

“We were already trading at extreme margins and with having to be Covid-ready, we’re spending so much more money on cleaning equipment and all the stuff we need. We were going to be trading at a loss so we wouldn’t be able to pass it on. Maybe by December if we’ve got some equilibrium.”

She also welcomed support for apprenticeships and subsidies for businesses that retain workers after the end of the furlough scheme in October.

“It’ll give us the chance to nurture people and help them grow into jobs. We have kept all our staff from day one. It means we can get more people back and try to give more hours, that’s how it’ll change things.

“Things were super-bleak a couple of weeks ago and now I’m fuelled by hope and if we can make it to next spring we should survive.”

But she reserved sympathy for pubs that rely more on alcohol sales, saying: “It will hurt them and hurt the industry if there are people who aren’t able to benefit. There’s always someone left out and help has to filter through to everybody.”

VAT cut for hospitality and tourism: the cafe supplier

Aatin Anandkat, a Leicester-based entrepreneur, fears that the VAT cut for the hospitality sector and discounts for cafes and restaurants may not benefit his bakery business.

As a supplier to cafes in the city, many of the 39-year-old’s customers remain closed because of local lockdown restrictions, even as the chancellor’s summer statement attempts to get consumers out spending on food and drink again.

“Not all pubs restaurants and cafes are open now. Does that incentive make me want to get back out there? It isn’t going to get me on the high street, even if it was free meals and drinks,” said Anandkat.

His company, Positive Bakes, is open for business selling vegan and ethically sourced food directly to the local community, while the city maintains tough lockdown controls. But while he praised Sunak for thinking creatively to tackle Covid-19 and for ramping up spending, he said continued help would be required in local areas.

“We need as a city to make it clear that there are businesses that are still trading that are doing good work. Yes, we must be mindful and stay safe following the guidance. But the reality is this will happen in other cities – it’s not just going to be Leicester.”