Good morning, and welcome to our global economy, financial markets, eurozone and business rolling coverage.

Inflation in the UK has fallen sharply in the past month, with clothing prices falling amid sales on Black Friday last month.

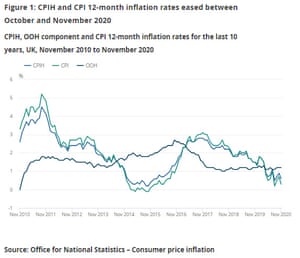

According to the National Statistics Office, consumer price indices rose only 0.3% in November from 12 months, falling to 0.7% in October.

The ONS added that food and non-alcoholic beverages have also reduced the cost of living in the past month, increasing the cost of living and some games.

It says:

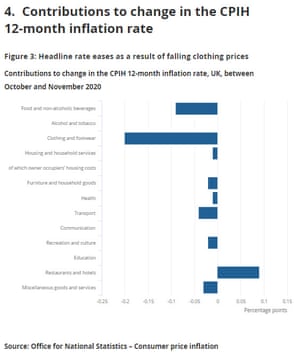

- The decline in the prices of clothing, and food and non-alcoholic beverages contributed to the lowest change in CPIH 12-month inflation rate between October and November 2020 (0.17 and 0.09 percentage points, respectively).

- These were partially offset by ward-up contributions to games, toys and hobby and housing services.

ONS says clothing prices were a major cause of lower inflation last month, with clothing and footwear prices falling 2.6% in November compared to October.

This points to the rise of discounts on Black Friday last month as retailers tried to boost sales, especially online sales, after a very rough year.

ONS explains:

Overall prices fell 2.6% between October and November 2020, up 1.0% from the same two months a year ago. Prices usually rise within these two months, but by 2020 the price movement was abnormal compared to the previous year and appears to have been affected by the coronavirus lockdown.

Prices in November of this year reflected rising growth discounts and some media outlets have reported that sales on some Black Fridays have spread further throughout the month.

Feedback to follow more details and …

I’m still coming

A jolt of surveys by purchasing managers in the UK, the Eurozone and the US will indicate how companies are carrying out this month.

These flash PMIs are likely to show that the UK private sector has grown this month, with output declining faster than in the UK during the November shutdown, with factories growing faster than the services sector.

The eurozone economy may still shrink, although tougher restrictions have been imposed to combat the second wave of Covid-19.

Michael Hewson Of CMC Markets Explanation:

The latest flash PMIs for the UK are expected to paint a somewhat better picture for the UK economy after the November recession, with both manufacturing and services improving, with production expected to be more resilient than 56 years due to a component of pre-Brexit stock piling, a November ban. Services are expected to return as soon as the economy reopens.

Germany and the Netherlands will be sickened by the prospect of an extended lockdown, as well as the lifting of some restrictions in France and the outlook for the largest economy in Northern Europe over the next few weeks. Today’s flash PMI for manufacturing and services is expected to deepen the economic gloom, even helping to reduce losses in the sector that manufacturing sectors are taking.

In both France and Germany, the diagnosis already looked weak before the extended restrictions were announced in early November, as hopes of a summer recovery have led to long dark winter pessimism.

Later, the US Federal Reserve, the Federal Reserve, will hold its final meeting of the year.

Plan

- 9 am GMT: Eurozone Flash PMI Services and Production Index for December. Expect to rise from 45.3 to 45.8, showing contraction.

- 9.30am GMT: UK Flash PMI Services and Production Index for December. Expected to rise from 49 to 53.1, expected

- 1.30 pm GMT: US retail sales for November. Expect a 0.3% decline month-on-month

- 2.45 pm GMT: US Flash Services and Production Index for December. Expect a slow rise to 56.7 from 55.7

- 7 pm GMT: Federal Reserve FMC meeting

- 7.30 pm GMT: Federal Reserve press conference