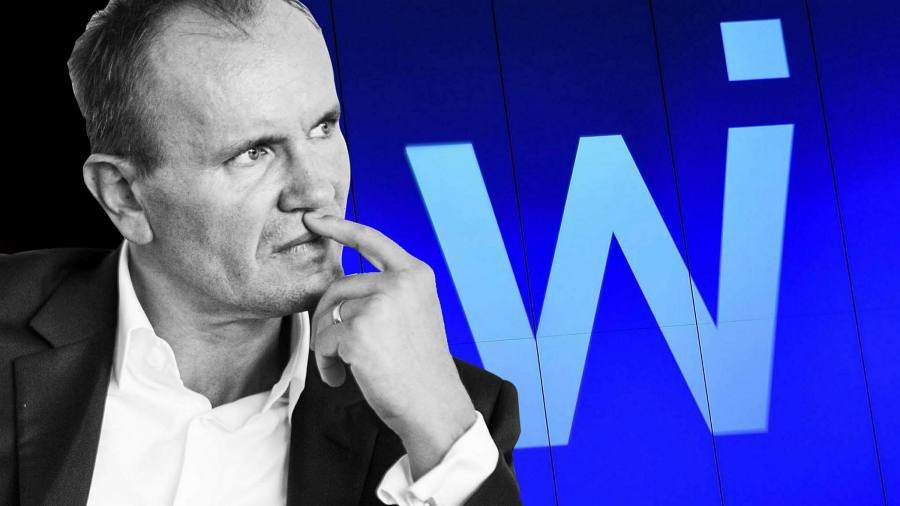

Former Wirecard main govt Markus Braun has been accused by Munich prosecutors of committing a multiyear fraud and arrested for a 2nd time subsequent the June collapse of the German payments group.

The prosecutors now suspect Wirecard’s accounting fraud commenced as early as 2015 when Mr Braun and other suspects allegedly agreed to inflate Wirecard’s profits in an attempt to deceive traders.

Investigators have broadened their investigation into the downfall of the company to involve other previous executives, the prosecutors claimed, with Wirecard’s previous finance manager, Burkhard Ley, and the group’s head of accounting, Stephan von Erffa, taken into custody.

The new arrests imply four Wirecard personnel have now been detained by German authorities. Mr Braun’s €5m bail has been revoked.

After a regular-bearer for Germany’s tech sector, Wirecard collapsed previous thirty day period after acknowledging a multiyear accounting fraud and warning that the €1.9bn of hard cash on its books in all probability did “not exist”.

The new arrests came as the German federal government discovered that a former formal in the German chancellery had personally lobbied for the disgraced payments corporation, a revelation that could prove uncomfortable to the administration of Angela Merkel.

Klaus-Dieter Fritsche, who applied to co-ordinate the work of the German intelligence companies in the chancellery, established up a meeting with Lars-Hendrik Röller, Ms Merkel’s senior financial adviser, and senior Wirecard executives in September 2019.

The get-together, on September 11, was attended by Alexander von Knoop, Wirecard’s chief monetary officer, and Mr Ley, as effectively as Mr Röller and Mr Fritsche. The chancellery explained it as a “getting-to-know-you” session, even though Wirecard also informed the officials about its enterprise activities in the Considerably East.

According to a specific summary of contacts amongst the chancellery and Wirecard, observed by the FT, Ms Merkel also fulfilled 1 of the company’s lobbyists, Karl-Theodor zu Guttenberg, a former German defence minister who is now chairman of Spitzberg Companions, an investment decision and advisory firm headquartered in New York. The conference took spot on September 3, 2019, ahead of Ms Merkel’s 12th official trip to China, and Wirecard came up for the duration of their conversation.

Govt officers insist that the chancellor was unaware of problems at Wirecard at the time of the excursion. Having said that officers have acknowledged that Olaf Scholz, the finance minister, was manufactured informed of suspected irregularities at the firm in February 2019 — just about a 12 months and a fifty percent before it collapsed.

MPs are to interrupt their summer months recess to grill Mr Scholz and economic climate minister Peter Altmaier at a unique session of the Bundestag’s finance committee next week. Some opposition politicians have named for a parliamentary inquiry into the regulatory failings that led to the Wirecard debacle. German regulators, together with fiscal watchdog BaFin, have been harshly criticised for failing to act on early warnings on Wirecard.

Munich prosecutors said that in the very last five decades banking companies and other traders set €3.2bn into Wirecard. “Due to Wirecard’s insolvency, these funds are most in all probability missing,” claimed Anna Leiding, a prosecutor on the Wirecard investigation. “In interrogations, we were being advised about a strictly hierarchical procedure that was shaped by an esprit de corps and pledges of allegiance to the main govt as a leader.”

Mr Braun has previously denied wrongdoing. Legal professionals for the previous chief executive did not instantly respond to a Monetary Situations request for comment.

Jan Marsalek, the company’s previous chief functioning officer, has vanished but is required below an worldwide arrest warrant.

Previously this month, Oliver Bellenhaus, the Dubai-based mostly head of a Wirecard subsidiary at the core of the fraud, claimed himself to Munich prosecutors. A lawyer for Mr Bellenhaus said last 7 days that Mr Bellenhaus “was going through his person duty — unlike others”.

The prosecutors explained that a single suspect experienced turned into a chief witness and that this person’s co-procedure had served to appreciably advance the investigation. A man or woman common with the investigation informed the Fiscal Instances that Mr Bellenhaus was the chief witness. Mr Bellenhaus’s law firm declined to remark.

Mr Ley, a 61-calendar year-outdated former banker, was Wirecard’s main financial officer involving 2006 and 2017 and, according to his profile on company networking web site Xing, ongoing to do the job as a senior adviser to Wirecard’s management board until June 2020. When he retired as CFO in 2017, Mr Braun thanked him for an “extraordinary performance”.

Mr von Erffa, who joined Wirecard some 9 years back, alongside Mr Braun, Mr Marsalek, Mr Bellenhaus and other senior Wirecard workers earlier this yr briefed KPMG about the preparations with 3rd parties during a particular audit by the accounting organization, in accordance to paperwork viewed by the Fiscal Periods.