it expires 30 september ability to request Refund of VAT paid in 2020 in another EU country. Within the same period, the taxpayer who feels that he has made a mistake in the refund request already sent, will be able to submit second application, however, while respecting the same procedures and similar submission deadlines.

In the event that a Application for VAT refund is rejected Closer to the deadline, it is not possible to resend it in 5 days after the rejection receipt, preserving its timeliness.

Thus, for example, if the application is submitted on 30 September and rejected on the same day, the application is remitted by 5 October, in addition to end date, it is still considered Late.

Information that must be indicated in the refund request They may vary by EU country. In the refund application sent through the web, the description of the goods as per the codes contained in the specific reference table should be entered.

operation of Control and management of applications, before sending it to the competent State for reimbursement, is made by Pescar. operations center But information regarding the processing status of applications must be requested, after being sent to the competent EU state For competent foreign tax administration.

similar related information rejection of application, by the Foreign Tax Administration, the request should be made to him first and only then to the Pescara Operations Center.

In respect of VAT paid United Kingdom in the year 2020, is the refund process Expired on 31st March, 2021, e.t.c boycott of northern ireland the time limit for 30 September to request Reimbursement of VAT applicable on goods.

Any VAT paid in the UK (except Northern Ireland), After 1st January 2021so called. can be recovered using thirteenth instruction Previously only applicable to non-EU companies from the UK.

Taxpayer who wishes to request refund does not need to be registered (or eligible to be registered) UK VAT number, must not have its registered office or residence in the United Kingdom e UK should not deliver. To supply Means any sale made in the UK, whether occasional or habitual.

should also take care Application submission conditions, taking into account that the UK currently refers to the period of one year from 1 July to 30 June of the following year (previously it was January to December) and The refund request deadline falls on December 31st each year.

Request for a VAT refund for expenses incurred in the United Kingdom (except Northern Ireland) Between 1 January 2021 to 30 June 2021, e. must be submitted by Not after 31st December 2021.

NS British Administration for Revenue and Customs (HMRC, as compared to our revenue agency) requires a refund request in which a Minimum period of three months, with maximum twelve months With an annual time period (year / fixed period) from 1 July to 30 June of the following year. As for the repayment limit for a period of less than twelve months Minimum claim amount £130. Is.

Italian and European companies will be able to submit a request for reimbursement of VAT paid in Great Britain using VAT65A Form.

In the VAT refund request, Italian exporters have to “Italian VAT Certificate“Certifying the certified registration of activity in Italy.

The certificate should contain the name, address and official seal of the revenue agency, the name and address of the business owner, the nature of the business and the VAT number of the ‘activities’.

the certificate will be valid for twelve months and will be accepted for all refunds made during that period.

at the end of twelve months a new certificate The latter is linked to the VAT refund request. In addition, the certificate can also be completed using the HMRC VAT66A form and must contain all the required information.

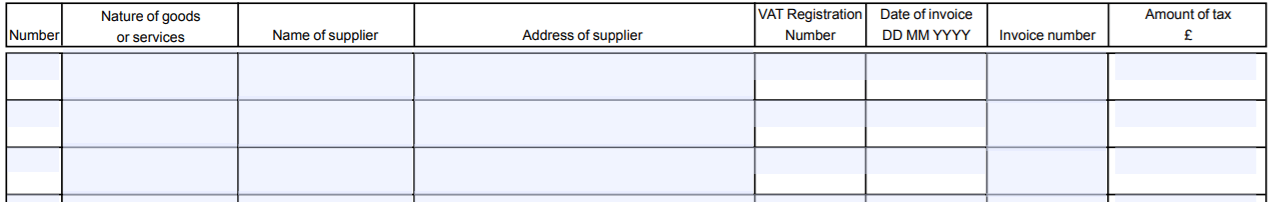

Applicant should be able Prove that you have invoices, coupons or receipts from suppliers Containing: an identification number, name, address and VAT number of the supplier, name and address of the applicant, description of the goods or services supplied, date of supply of the good/service, cost of goods or services (excluding VAT), VAT Rate and amount of VAT charged. If the value of the expenditure or . Is Requires simplified data of less than £250.

If the applicant has imported goods into the UK, they must have an import VAT certificate or other customs document showing the amount of tax paid. Along with the application the taxpayer has to provide Original copy of all invoices and import documents (Copies are not accepted).